Buying Farmland and Some Cows Can ACTUALLY Save You on #Taxes? It’s true — much to the dismay of…

Posted by wpadmin | Posted in Business and Corporations, Financial Advisement, Government, Personal Finance, Taxes | Posted on 22-01-2016

Tagged Under : finances

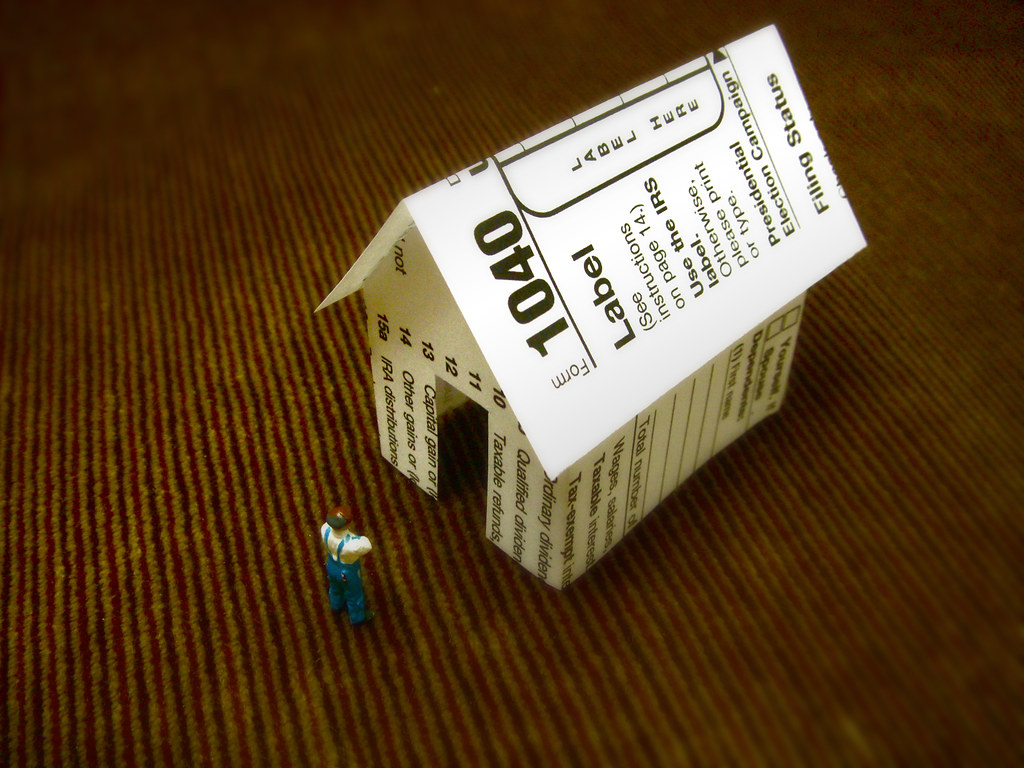

Buying Farmland and Some Cows Can ACTUALLY Save You on #Taxes?

It's true — much to the dismay of many of the middle class, and it's sneaky. But thanks to a slight loophole in tax law, many of the wealthy have been able to take their massive properties on rural land assessed for millions of dollars, get the "use-value assessment" typically reserved for farmers and obtain a property tax credit.

What then happens? It's that tax credit bringing the value of, say, a $71.4MM valued property down to as little as $290K! They're basically able to have that rural land at such a low cost in terms of property tax that it almost seems like a steal (it is, actually).

You simply need to prove that you live on the acquired rural land. That's it. You don't have to do any farming, tilling the soil, milking cows or maintaining a chicken coop. File your property taxes under this tax credit, and you're golden.

There are many other supposed "tax shelters" out there to help maximize your refund. Just click below! And be sure to sign up with #ITPN immediately and get your 2-hour tax return filed right away.

You’re probably wondering what tax shelters are and why they’re so important. Read this and find out how your tax refund could blow up huge!

The post Buying Farmland and Some Cows Can ACTUALLY Save You on #Taxes? It’s true — much to the dismay of… appeared first on Cloud Based Bookkeeping.

Share

Follow Us!

specifics might actually shock you, but we’ve broken it down to four verticals for your to keep in mind, but as always,

specifics might actually shock you, but we’ve broken it down to four verticals for your to keep in mind, but as always,