How a Dynasty Trust Can Save on Your Son’s #Taxes Later On Building wealth: that’s what business …

Posted by wpadmin | Posted in Business and Corporations, Financial Advisement, Government, Personal Finance, Taxes | Posted on 22-01-2016

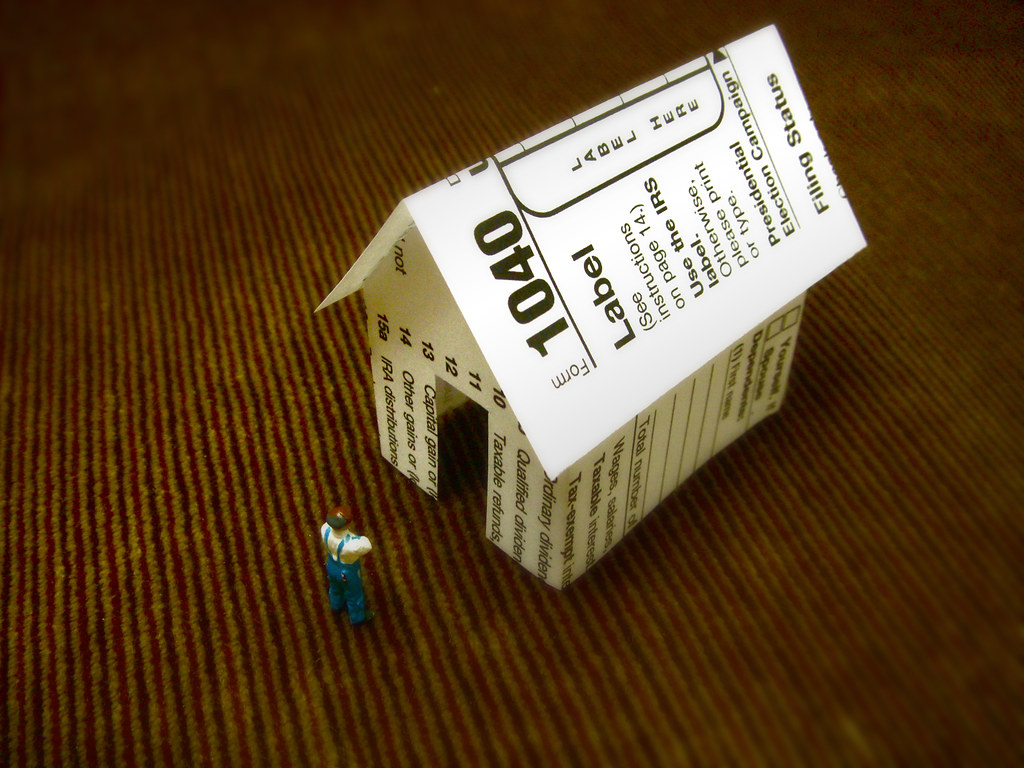

How a Dynasty Trust Can Save on Your Son's #Taxes Later On

Building wealth: that's what business is all about, and all of that effort will transfer over to a new CEO, a relative, our dog, and, yes, even our children. Enter: the dynasty trust, something that the #CBB values quite well in terms of continuing to make the wealth last long beyond your life.

What is a dynasty trust? It's an irrevocable trust, creating that generational wealth and allowing your descendants to benefit from these tax exemptions: estate, gifting, and generation skipping. And it lasts for the ENTIRE LIFE of the trust itself.

The trust can be funded in two different ways — while you're actually alive and kicking, or dead and long gone. Either way, in terms of business finances — if you have stocks, bonds, and even life insurance, or maybe you own some real estate — these are all items that can go into a dynasty trust and literally sit there, growing exponentially to the point that they have no cap. We're talking millions here.

Of course, your assets would be subject to income and capital gains tax unless you live in Texas, Nevada, or Florida — say HELLO to tax savings in that case!

That's where a dynasty trust could make a way for a pretty nice tax shelter — not just for you, but for those carrying on your legacy. Of course, you'd do well to consult with an attorney and sign up with Cloud Based Bookkeeping for more information. Get those taxes figured out and see if it's worth it (it's definitely worth it if you're in one of those three states).

And, of course, check out this link for even more tax shelters to maximize your refund.

You’re probably wondering what tax shelters are and why they’re so important. Read this and find out how your tax refund could blow up huge!

Share

Follow Us!

specifics might actually shock you, but we’ve broken it down to four verticals for your to keep in mind, but as always,

specifics might actually shock you, but we’ve broken it down to four verticals for your to keep in mind, but as always,

up new lines of credit, tarnishing the credit report, even contacting vendors and totally ruining the company from the ground up; or you could be handing over your credit card to someone who just might lose it, or have it in plain sight for a

up new lines of credit, tarnishing the credit report, even contacting vendors and totally ruining the company from the ground up; or you could be handing over your credit card to someone who just might lose it, or have it in plain sight for a